Simplified issue life insurance offers a fast and convenient way to secure coverage without a medical exam, relying instead on a simple health questionnaire. It is an ideal solution for seniors, busy professionals, or those needing immediate protection, though it typically comes with higher premiums and lower coverage limits than traditional policies. The article debunks the myth that this insurance is only for high-risk individuals, highlighting it as a legitimate option for anyone prioritizing speed and ease of application.

Simplified issue insurance is often misunderstood. Many think it’s only for high-risk individuals. This is not true.

This type of insurance offers a quick and easy way to get coverage. No medical exam is needed.

Instead, applicants answer a few health questions. This makes the process faster and less invasive.

Simplified insurance is ideal for those who need coverage quickly. It’s perfect for busy people or those with health concerns.

Despite its convenience, some myths persist. Many believe it offers inadequate coverage.

In this article, we will debunk these myths. We’ll explore the benefits and limitations of simplified issue life insurance.

Simplified issue insurance is a type of life insurance. It requires no medical exam, making it appealing for many. Instead, applicants complete a short health questionnaire.

This insurance aims to provide quick coverage. It's ideal for those who need to secure policies rapidly. The application process is easier and faster than traditional methods.

Here's what characterizes simplified insurance:

Despite the lack of a medical exam, insurers still assess risk. They evaluate the completed questionnaire and may check prescription history. This helps them determine eligibility and premiums.

Simplified issue life insurance is suitable for various people. It includes seniors or those with minor health concerns. This insurance provides a convenient path to coverage without delay.

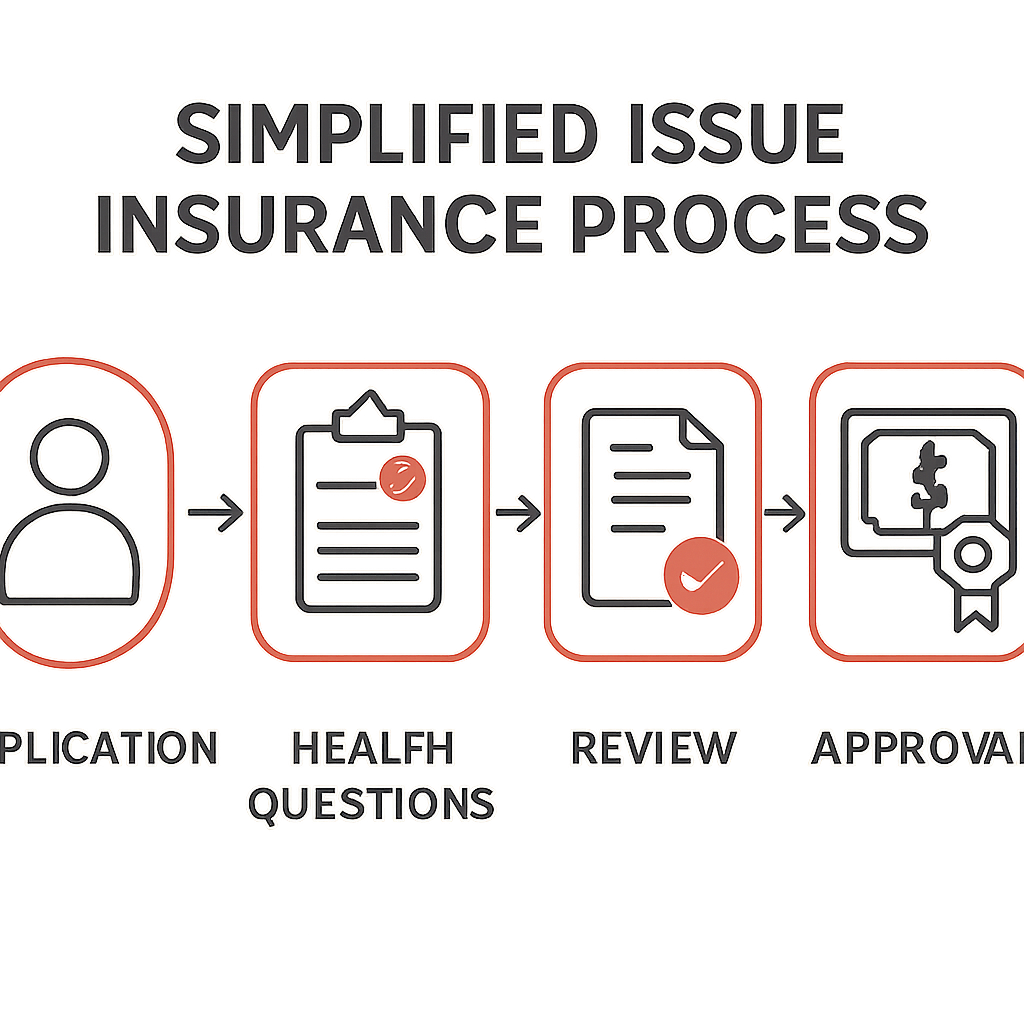

Simplified issue life insurance operates without the need for medical exams. When applying, you'll complete a brief health questionnaire. This questionnaire gathers essential health information quickly and easily.

The insurer reviews your answers to assess risk. They may also analyze prescription history or medical records if needed. This streamlined process often results in quicker approval times compared to traditional policies.

Key features of how it works:

This type of insurance is often chosen for its speed and convenience. Coverage can sometimes be granted within days. This makes it a preferred option for individuals facing time constraints or urgent needs.

Simplified issue insurance is versatile. It caters to people seeking a hassle-free way to secure life insurance. It's especially appealing to those who prefer avoiding lengthy medical exams.

Simplified issue insurance is often misunderstood, leading to myths about its risks. One common myth is that it's only for high-risk individuals. In reality, it's suitable for various profiles, including those seeking fast coverage.

Another misconception is that it's not real life insurance. Simplified insurance provides valid coverage, contrary to this myth. It's a legitimate option for many who prioritize speed and ease.

Some believe it's vastly more expensive than other policies. While premiums can be higher due to the absence of a medical exam, they are competitive. Comparing rates across insurers helps find affordable options.

Here are some myths debunked:

It's also falsely thought to provide inadequate coverage. In contrast, it meets numerous needs, from loans to family protection. Available coverage amounts can adequately support many financial goals.

Lastly, many think simplified insurance lacks customization. Numerous policies offer riders for added benefits. Options like accidental death and critical illness riders enhance coverage. Simplified issue insurance is versatile and can be tailored to fit personal needs.

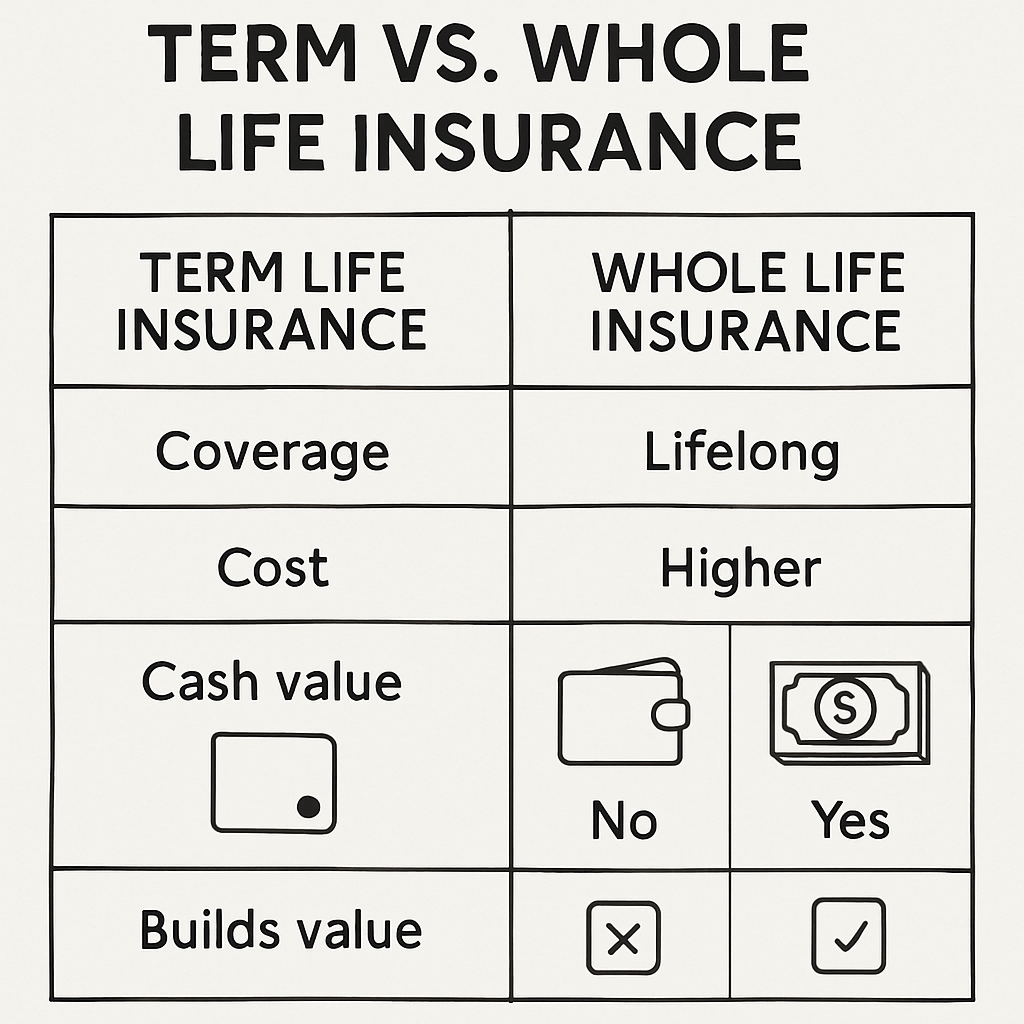

Simplified issue insurance contrasts with other life insurance types primarily in the application process. Traditional life insurance often requires a medical exam, while simplified insurance bypasses this step. This leads to quicker policy approval, appealing to those needing swift coverage.

Coverage amounts for simplified issue insurance are typically lower than those of fully underwritten policies. This factor influences its affordability and suitability, depending on individual financial needs and goals.

When comparing, consider the following differences:

Simplified issue insurance serves best those needing quick solutions without extensive medical scrutiny. However, traditional policies might suit those desiring higher coverage and potentially lower costs. Evaluating personal circumstances and future goals is crucial when selecting the right policy.

Simplified issue insurance appeals to diverse groups seeking life insurance. It is particularly attractive to those who require quick coverage without medical exams. Seniors and individuals with mild health issues find it accessible due to the simple application process.

Busy individuals unable to attend medical exams can benefit greatly. Simplified insurance is an excellent choice for those with tight schedules or demanding jobs. Additionally, it suits people who previously faced application denials from traditional insurers.

Young, healthy individuals may opt for simplified policies for convenience. However, they should weigh potential cost differences against fully underwritten options. Understanding one's unique needs and circumstances can inform whether this type of insurance is the right choice.

Simplified issue life insurance offers distinct benefits. The application process is quick and effortless. There’s no need for medical exams, making it ideal for immediate coverage needs. It’s also accessible for those with health issues that might complicate traditional coverage.

However, simplified policies have limitations. They often come with higher premiums due to the absence of a medical exam. Coverage amounts are generally lower than fully underwritten policies, which can be a drawback for some.

While simplified issue life insurance is convenient, it's essential to weigh its benefits against the drawbacks. For many, the speed and simplicity are worth the trade-offs. Evaluating personal needs and financial goals can guide whether this policy type suits you.

Applying for simplified issue insurance is straightforward. Unlike traditional policies, no medical exams are involved. Instead, you’ll answer a series of health-related questions.

The process can be completed online or over the phone. It typically takes a few minutes. An instant decision is often possible, providing quick peace of mind.

Approval relies on your answers and sometimes a prescription drug check. Be honest to avoid claim denial later. Overall, the simplicity and speed make applying for simplified issue insurance accessible and easy, especially for those needing quick coverage.

Finding the best simplified issue insurance policy requires thoughtful consideration. First, evaluate your personal and financial needs. Consider the coverage amount that suits your long-term goals.

Next, compare options from different insurers. While premiums and benefits can vary, understanding these differences ensures you get the best value. Always check for additional policy features, like riders that may enhance your coverage.

Finally, consult with a knowledgeable insurance agent. They can provide insights tailored to your specific situation. This guidance can streamline your decision-making process and help you choose a policy that fits your needs perfectly.

Many people have questions when considering simplified issue insurance. Understanding the basics can help determine if it's the right choice. Here are some common inquiries.

It's important to consult with an insurance expert if you have specific questions. They can provide personalized answers and guidance. This ensures you make a well-informed decision when choosing your policy.

Deciding on life insurance is a major step. Simplified issue insurance offers the convenience of a quicker application without medical exams. Yet, it might come with higher premiums and lower coverage limits.

Assess your needs before making a decision. Consider your health, the amount of coverage you need, and how quickly you want it. This can guide you toward the right choice.

Consult with an insurance expert to explore your options. They can help you understand the intricacies and find a policy that fits your unique situation. With the right guidance, you can choose a policy that provides peace of mind and aligns with your financial goals.

Simplified issue life insurance offers a fast and convenient way to secure coverage without a medical exam, relying instead on a simple health questionnaire. It is an ideal solution for seniors, busy professionals, or those needing immediate protection, though it typically comes with higher premiums and lower coverage limits than traditional policies. The article debunks the myth that this insurance is only for high-risk individuals, highlighting it as a legitimate option for anyone prioritizing speed and ease of application.

Easily compare life insurance quotes online to find affordable policies that suit your needs. Save time and make informed decisions with our comprehensive guide.

An Expert's Guide to Choosing Your Life Insurance Policy.

Making Life Insurance Less Complicated and More Meaningful.